Scaling AI - Is it on your 2023 Roadmap yet?

Scaling AI is high up on the agenda of everyone in 2023. With the generative AI boom introducing a new-found urgency to successfully introducing and scaling AI, it is now simply a question of survival if banks and financial institutions can make it work.

AI applications reduce time, effort and cost for organizations of all sizes, taking care of crucial functions in fraud detection, personalization and customer assistance. The larger the institution, the more likely it is that they are already implementing AI strategies: 75% of banks with over $100 billion in assets already have one in 2020.

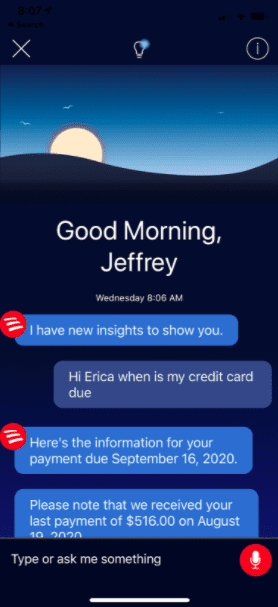

AI use cases in banking now range from cybersecurity, credit decisioning, churn reduction, personalized services and products to fraud and anomaly detection. The race has been on for the past few years to develop truly AI-first banking services. Here is an early attempt from the Bank of America in 2021:

While Bank of America is one of the big players who already had a robust AI plan in place back then, 74% of C-suite banking executives surveyed by Accenture believe if they don’t figure out scaling AI in the near term, they’ll go out of business within five years.

Five. Years. And that was in 2021.

The referenced study by Accenture - the main points of which we will recap in this blogpost - shows that approximately 84% of C-Suite executives know they must leverage AI to reach growth goals. Yet, a staggering 76% said they struggle with the task of scaling.

What’s even more alarming - it appears that less than 25% of banks are effectively and strategically scaling AI today. However, there’s good news. The ones that are scaling AI are achieving insane ROI (nearly 3 times the return on investment compared to their counterparts).

If scaling AI was easy, everyone would do it

Scaling is easy when you are big, right? Not necessarily. Larger banks, like BoA and its top competitors, may face complex enterprise rules, siloed infrastructure and way too much red tape.

However, they also might achieve greater investment returns due to their ability to invest and spread innovations throughout their organizations. So for these giants it’s well worth the effort to work their way around organizational hurdles. What about smaller players? Should they even try to scale and compete?

After grouping the surveyed companies by size, Accenture found that scaling success rate and ROI had little to do with the size of the company. What it really comes down to is establishing a framework and culture that empowers your company and employees to thrive. No matter how large or small your financial institution is, you’re just as likely to succeed with AI. All you need to do is meet the three main challenges of scaling.

Three main challenges financial institutions face when trying to scale AI:

#1 Lack of clear AI strategy from the top

#2 Misaligned planning and governance across teams

#3 Overwhelming amount of data or a lack of it

Challenge #1: Lack of clear AI strategy from the top

Solution: Get others involved

Companies that have successfully scaled AI typically get buy-in from the top. To be a strategic scaler requires alignment from the C-suite, and this usually means you need to appoint a Chief Data, Analytics or AI Officer. Does your financial institution have someone with this title or role? If not, it’s time to find her.

To scale strategically, the most efficient banks create holistic AI teams. These teams need to combine expertise from numerous areas and departments with backgrounds in machine learning, AI, data science, as well as engineering, and also need to include specialists focused on data quality, dashboards and management.

By establishing such multidisciplinary teams, a company-wide behavioral change is created, fostering a culture of embracing AI, speeding up the overall process and success rate. A staggering 92% of the strategically scaling companies mentioned by Accenture follow this model.

Challenge #2: Misaligned planning and governance across teams

Solution: Be methodical in your approach

While many financial institutions take a startup-like approach by zigzagging between potential solutions to figure things out as they go, the most effective way to scaling AI is to establish structure and governance to help guide strategy and planning.

Planned initiatives must align with true business needs and each challenge must be assigned to a specific stakeholder who reports to the head of AI. This setup reduces the likelihood of misaligned efforts and ensures there is clear ownership of each project. The head of the AI team needs visibility to hold this person and her team accountable, and to also keep the C-suite and the board invested and updated.

It might sound counterintuitive but in order to move quickly and accomplish more in less time, you first need to slow down. Scaling AI requires a long-term commitment and a high-level strategy. Believe it or not, the most effective AI-focused executives at banks set longer and more realistic timelines, which empowers them to pilot and then launch more initiatives across their organizations.

In fact, as the Accenture study points out, 65% of the successfully scaling banks plan 12-24 months to pilot and scale new AI projects. Thanks to the super methodical and intentional approach, these financial institutions end up spending less time and money overall: their pilots succeed and are then implemented at a greater scale.

Challenge #3: Overwhelming amount or lack of data

Solution: Identify and synthesize business-critical data

If your organization has difficulty making sense of the crazy amount of data it’s collected, you’re not alone. According to IBM's report from 2016, more than 90% of all data in the world at that time was generated in the space of only two years! Most organizations don’t know how or what to do with it all. Even after data has been collected, it must be organized, managed, sanitized, and shared so that it can be utilized effectively.

The most efficient banks sift through all their repositories and identify the most important data to share. This includes data that can ultimately be used to improve engagement, drive revenue and reduce fraud.

In order to accomplish these goals, customer transaction and production data must be shared across borders, between teams, and with external vendors—which can be difficult to do because of compliance rules tied to financial and privacy sensitive data.

To overcome these privacy hurdles, banks leverage AI-powered synthetic data to create cloud-based synthetic data lakes. Repositories like this can then be accessed by teams in and out of the bank to accomplish their goals, like working with imbalanced datasets to improve algorithms to mitigate fraud. And this brings us full circle.

Synthetic data empowers banks to make data readily accessible, which results in a greater number of people and teams involved, and fosters a culture of collaboration. It also creates the foundation of a scalable AI process and playbook all teams can leverage. JPMorgan is already using synthetic data to conduct pilots with vendors that require privacy sensitive business-critical data. And you can too.

These teams onboard other AI vendors which promotes a positive cycle that can propel your bank to new levels of success. These thriving banks are discovering AI platforms that improve their machine learning capabilities resulting in quicker identification of data that should be synthesized and shared with other teams.

Scaling AI starts with the data. It's time to replace code with data and to do so with maximum attention to privacy, fairness and security.

Key learnings for scaling AI

Companies that successfully reached new heights established data-minded multidisciplinary teams across key verticals. Their specialists and experts achieved results by fostering a culture that embraces AI and by taking the following actions to heart:

- Realize an effective alignment strategy from the C-level downwards by appointing a Chief Data, Analytics, or AI Officer.

- Establish structure and governance to help guide strategy and planning.

- Set realistic timelines. Successful projects planned 12-24 months to pilot and scale new AI projects.

- Make business-critical data assets readily accessible by leveraging AI-powered synthetic data to create cloud-based synthetic data lakes.